Understanding and Completing the Sempra Form W9 for Tax Compliance - January 2025 Update

====================================================================================

As the new year begins, businesses and individuals alike are preparing for the upcoming tax season. One essential document for tax compliance is the

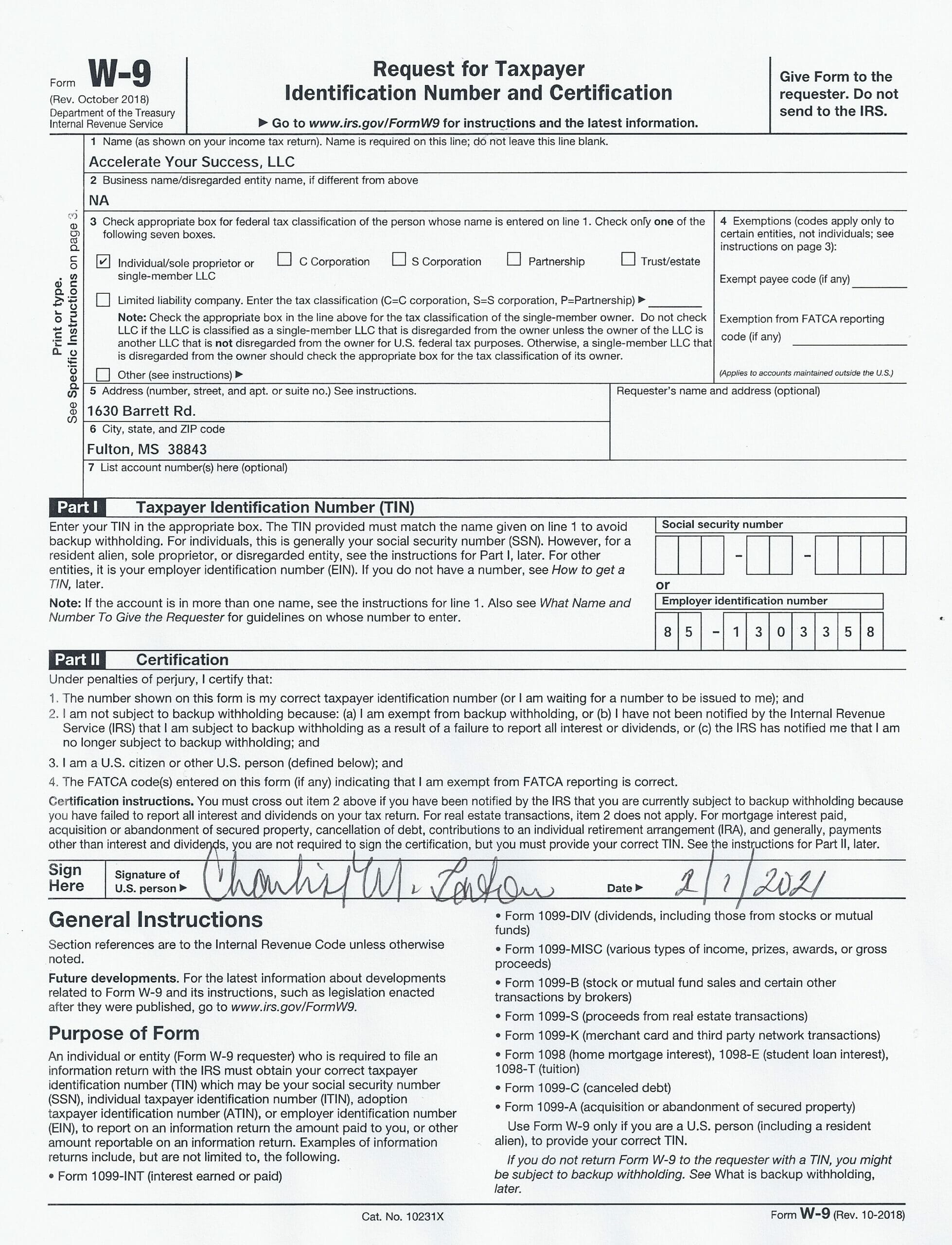

PDF Sempra Form W9, which is used to provide accurate taxpayer identification information to the Internal Revenue Service (IRS). In this article, we will discuss the significance of the Sempra Form W9, its contents, and how to complete it correctly, with a focus on the January 2025 update.

What is the Sempra Form W9?

-----------------------------

The Sempra Form W9, also known as the Request for Taxpayer Identification Number and Certification, is a document used by businesses and individuals to provide their taxpayer identification number (TIN) to the IRS. This form is typically required by payers, such as employers, banks, and other financial institutions, to verify the identity of their payees, including independent contractors, freelancers, and vendors. The Sempra Form W9 is usually provided in a

PDF format, making it easily accessible and downloadable.

Contents of the Sempra Form W9

---------------------------------

The Sempra Form W9 typically includes the following information:

Business name and address

Taxpayer identification number (TIN), which can be either a Social Security number (SSN) or an Employer Identification Number (EIN)

Type of tax classification (e.g., individual, sole proprietor, partnership, corporation)

Certification that the provided information is accurate and that the taxpayer is not subject to backup withholding

How to Complete the Sempra Form W9

--------------------------------------

To complete the Sempra Form W9, follow these steps:

1.

Download the PDF form: Visit the official IRS website or the Sempra website to download the latest version of the Form W9 in

PDF format.

2.

Fill out the form: Enter your business name, address, and TIN in the designated fields. Make sure to use your legal business name and address.

3.

Select your tax classification: Choose the correct tax classification for your business, such as individual, sole proprietor, partnership, or corporation.

4.

Certify the information: Sign and date the form to certify that the provided information is accurate and that you are not subject to backup withholding.

5.

Return the form: Submit the completed Form W9 to the payer, usually via email or online portal.

January 2025 Update: What's New?

--------------------------------------

The January 2025 update of the Sempra Form W9 includes minor revisions to the form's layout and instructions. The changes aim to improve the clarity and readability of the form, making it easier for taxpayers to complete and submit. Additionally, the updated form reflects the latest IRS guidelines and regulations, ensuring that taxpayers are in compliance with current tax laws.

----------

In conclusion, the Sempra Form W9 is a crucial document for tax compliance, and understanding its contents and completion process is essential for businesses and individuals alike. By following the steps outlined in this article and using the latest

PDF version of the form, taxpayers can ensure accurate and timely submission of their taxpayer identification information to the IRS. Stay up-to-date with the latest tax regulations and guidelines by visiting the official IRS website or consulting with a tax professional.